The University of Pittsburgh is committed to incorporating ESG factors in the management of the Consolidated Endowment Fund (CEF), the University's largest financial asset.

Since March 2020, the Investment Office, which manages the CEF, has followed an ESG Policy for the CEF. The ESG Policy provides the University with a more consistent and comprehensive approach to evaluating investment opportunities.

The ESG Policy states the University’s commitment to “fully integrating ESG factors into the University’s decision-making processes, on the core belief that supporting responsible business practices also supports strong investment outcomes.”

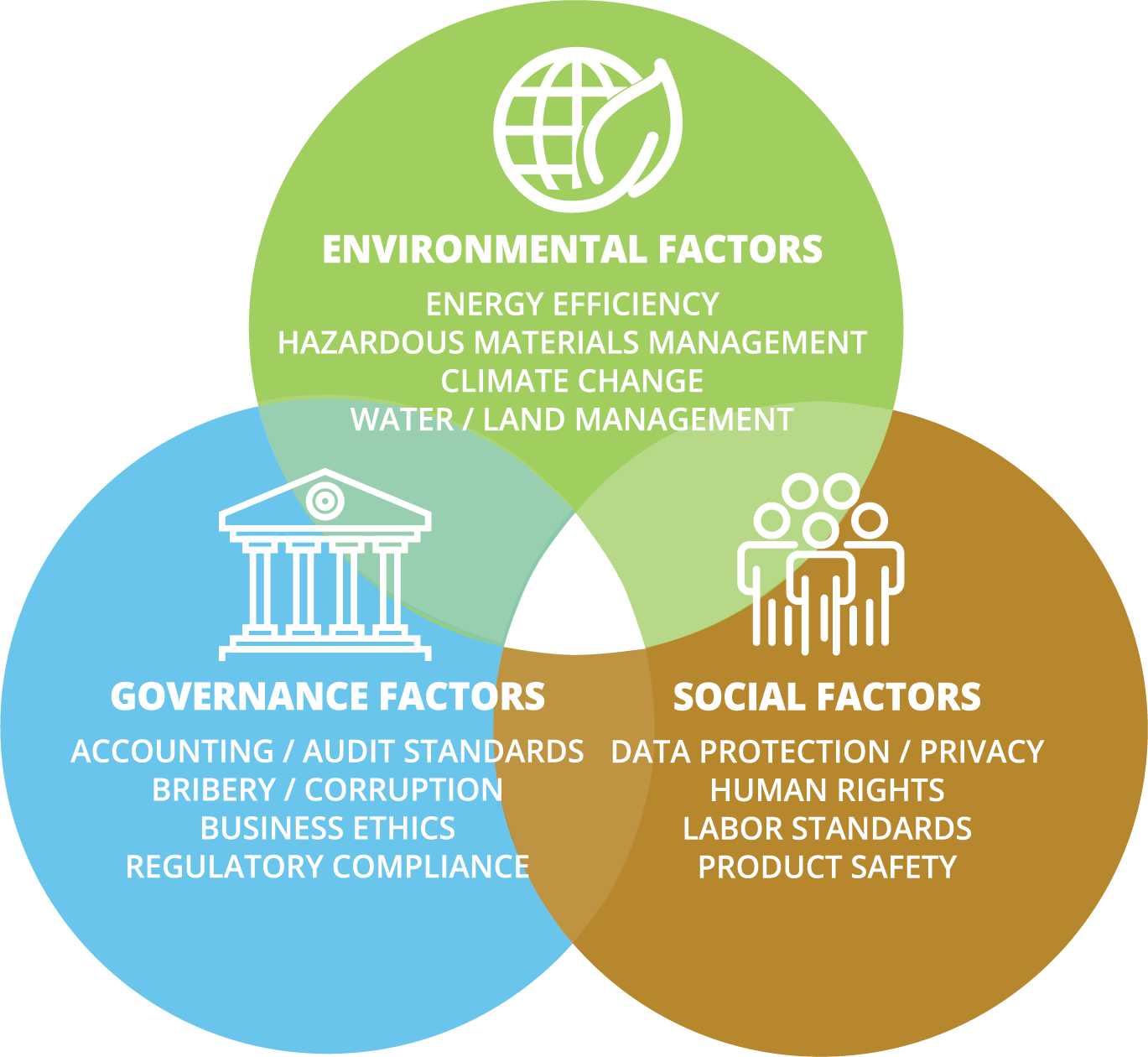

Though ESG factors vary based on the type, industry, and scope of an investment, the ESG Policy outlines how the Investment Office considers a range of factors when evaluating investment risk.

Those factors could include energy efficiency, hazardous materials management, climate change, water and land management, data protection and privacy, human rights, labor standards, product safety, accounting and audit standards, bribery and corruption, business ethics, and regulatory compliance.

Third ESG Report Published

The third annual ESG report (PDF) was published in May 2024, reflecting information from Fiscal Year 2023. The report provides updates on the following:

- The CEF’s fossil fuel exposure.

- External investment managers currently overseeing approximately 93% of the CEF by value have formal ESG policies in place or take ESG considerations into account when making investments.

- Although the University does not preemptively exclude fossil fuel investments, known as applying a negative screen, the University has not made any direct investment in fossil fuel companies or new commitments to fossil fuel funds in more than three years.

A high-level overview of the report can be found in this Pittwire article.

The Investment Office continues to meet with key student organizations on a regular basis as well as speak at various University forums to enhance overall awareness and improve dialogue on this important topic.

Second ESG Report Published

In an effort to continue to enhance transparency regarding the CEF and the implementation of the ESG policy, the second annual ESG report (PDF) was published in April 2023, reflecting information from Fiscal Year 2022. The report provides updates on the following:

- The CEF’s fossil fuel exposure.

- The CEF’s approach to direct engagement with underlying companies in which the endowment holds investments and the use of proxy voting.

- External investment managers currently overseeing approximately 87% of the CEF by value have formal ESG policies in place or take ESG considerations into account when making investments.

A high-level overview of the report can be found in this Pittwire article.

Inaugural ESG Report Launched

In March 2022, the University of Pittsburgh’s Investment Office released the “Inaugural Consolidated Endowment Fund Environmental, Social and Governance Report" (PDF). The Fiscal Year 2021 report details how the University of Pittsburgh incorporates environmental, social, and governance (ESG) factors in the management of the University’s Consolidated Endowment Fund (CEF). The report “seeks to provide greater clarity regarding how ESG factors are applied in the [University’s] investment decision-making process as well as report on fossil fuel trends.”

A high-level overview of the report can be found in this Pittwire article.