The Investment Office is responsible for the oversight and management of the University’s Consolidated Endowment Fund (CEF), which had a market value of $6.1 billion on June 30, 2025. The CEF supports financial aid, scholarships, faculty positions, and research activities and links past, current, and future generations of University stakeholders, including students, faculty, and staff.

To achieve that goal, the primary investment objective of the CEF is to earn a rate of return over an extended period that is sufficient to support a prudent spending policy while preserving its inflation-adjusted asset value. It is the University’s core belief that supporting responsible business practices is integral to producing strong investment outcomes.

Review the Statement of Governance, Investment Objectives and Policies (PDF) for the CEF.

The CEF is an investment pool composed of over 3,000 individual endowment funds, all with designated purposes or restrictions, that are commingled (pooled together) to facilitate more efficient investment. Each endowment fund that the University accepts has a clearly stated, legally binding purpose for the assets provided to which the University must adhere. Additionally, the legal documents accompanying CEF investments typically include confidentiality provisions that prevent the University from disclosing specific investments or investment managers. Confidentiality provisions are deemed necessary to avoid impairing long-term investment returns.

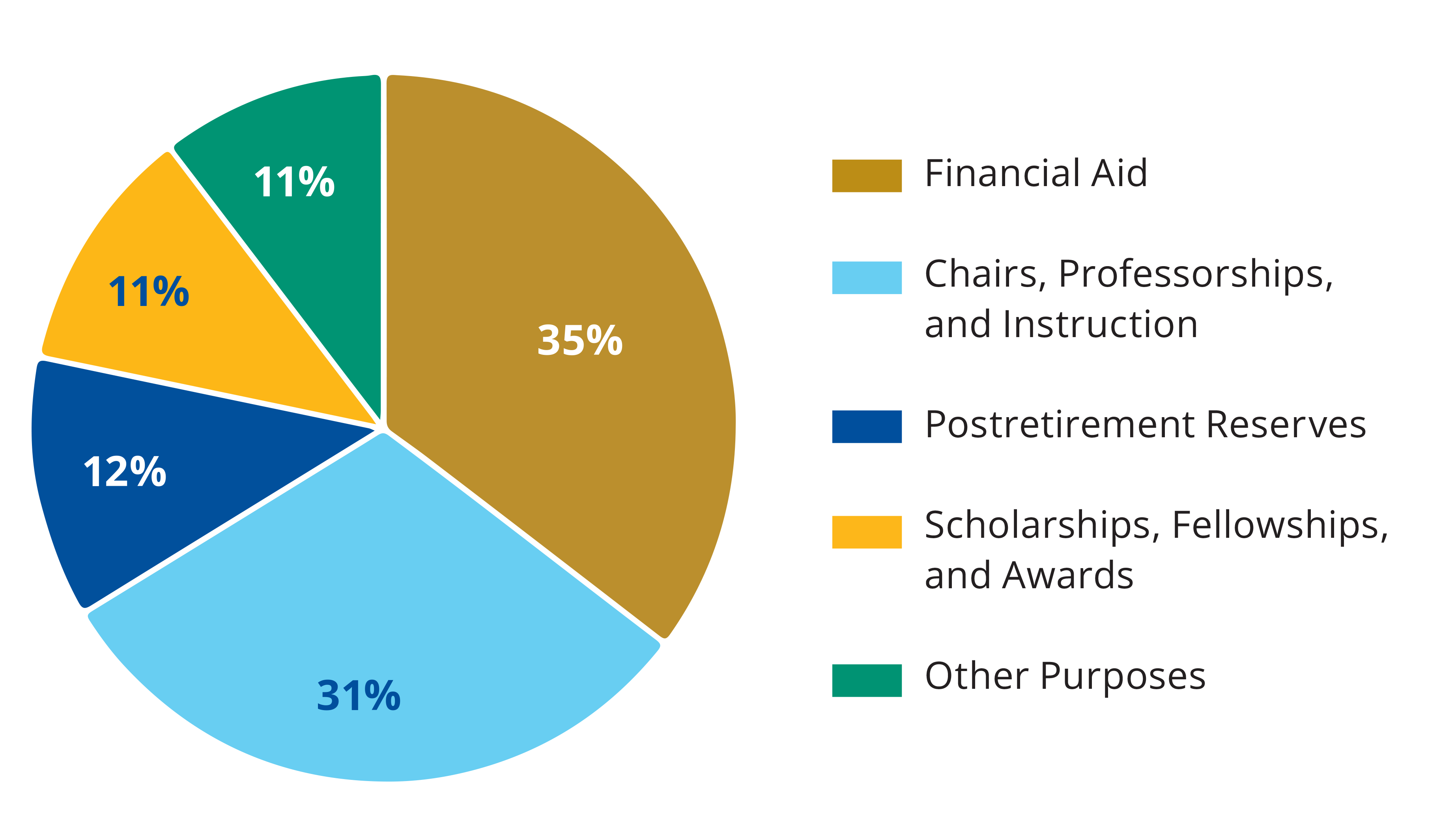

This chart indicates the defined purposes for Pitt’s CEF funds. These endowed gifts provide perpetual financial support for scholarships, fellowships, faculty chairs, instruction, and other University programs and services.

Note that “Other Purposes” include research, library and public service, general and undesignated funds, long-term reserve fund, and development and institutional support. The University provides postretirement medical and life insurance benefits to eligible employees and their spouses upon retirement through a contributory benefit plan. The University has elected to fund its postretirement liability via a designated endowment fund that is managed within the CEF and referred to as postretirement reserves.

Among CEF objectives, the most critical to the University’s mission is the long-term preservation of assets on a real (inflation-adjusted) basis, while providing a meaningful stream of income to University beneficiaries.